Help agencies to define their new business objectives and then create professional software.

Banque Du PTG is proud to offer SecurLOCK Equip, our solution to mobile card control. This new mobile app gives you complete authority over how, when, and where your debit card is used. It will also alert you of any transactions that are authorized, so that you are instantly aware of potential fraud. The new app is available on iOS and Android today! For assistance, use our SecurLOCK Equip FAQ or contact your local office.

Banque Du PTG is proud to offer People Pay, and it couldn’t be easier! You’ll love being able to reimburse your coworker for lunch, pay the babysitter, or send your child at college some extra money for a job well done. All you need is a cell phone number or email address. Your recipient will receive a link with a claim code and can choose how they want to receive the funds, including a check payment, an electronic deposit to their account, or even a transfer to PayPal. What about that nephew’s birthday you forgot? Using People Pay, you can send him quick funds to use at his favorite store without ever needing to leave the comfort of your home. Log in today and enroll for the convenience of People Pay.

Text Banking is one of our newest services available to customers. In a

technologically mobile focused world, we’ve given our customers the option to

complete simple banking services with a text message. Please sign into your Online

Account from the homepage, go to the Mobile Banking Center, then Add Text Banking.

You will be taken through several quick steps to enroll your device for text and

mobile access.

After setup is complete, now send a text to 73955 that says C. This will send

you a list of your text banking commands. If you need help please contact one of our

offices.

Banque Du PTG is excited to offer Mobile Wallet payments to our customers. Let us help you experience convenience and safety in a new way while using your phone for more than selfies. Using your fingerprint, PIN, face or iris scan, simply activate the payment process on your compatible device and hold it near the payment terminal. Mobile Wallet uses virtual card numbers, so the businesses you shop at never know your business! Even better, use your Mobile Wallet for in-store and online payments. To get started, add your PTBA EZ Check Debit Card to Apple Pay, Google Pay, or Samsung Pay today.

A $3.50 service charge if balance falls below minimum $1,000.01.

An additional $3.50 charge to receive paper statements. Enroll with E-Statements to avoid the paper statement fee.

No monthly service charge, regardless of balance.

Available to students age 26 and under.

No fees for using an ATM we do not own. *Ask us for details

A $6.50 service charge if balance falls below a minimum of $5,000.01.

Earns variable interest for balances greater than the minimum.

Earns variable interest for balances of $4,000.01 and greater.

Enjoy the perks of a Club Checking account like Cell Phone Insurance, Identity Theft 911, and more.

Service charge varies on type of account:

Ask your PTGbanking associate for details.

PTG's Traditional Personal Money Market account offers special rates for the large balance saver.

With all the above accounts, we offer Voice Banking, Online Banking, Bill Pay.

The PTGTraditional Business checking account is designed for the growing business with changing needs. Like our Traditional Personal Checking, you get all the benefits of a “large balance” account at a minimum cost to you. This account has no service charge if you maintain a required balance, but if you happen to fall below that balance you will be charged a flat rate per month.

$0-$25,000 - $15.00 per month$25,000.01 and up - no chargeNo per item chargeMinimum deposit required to open is $100.00Additional $3.00 charge to receive paper statements. Enroll in E-Statements to avoid the paper statement fee. Traditional Business Interest

Get more from your checking account by choosing PTG's Traditional Business Interest checking. This is an interest-bearing account. With this account, you have unlimited check writing capabilities while earning a higher rate of interest.

$0 - $50,000.00 - $25.00 monthly service charge; 0% interest$50,000.01 - $100,000.00 - $12.00 monthly service charge; variable interest rate$100,000.01 and up - No service charge; variable interest rateMinimum deposit required to open is $100.00Traditional Business NOW

If you want to put your money to work, PTG's Traditional Business NOW checking account is for you. This is an interest-bearing account available to specific business types.* With this account, you have unlimited check writing capabilities while earning a higher rate of interest.

$0 - $50,000.00 - $25.00 monthly service charge; 0% interest$50,000.01 - $100,000.00 - $12.00 monthly service charge; variable interest rate$100,000.01 and up - No service charge; variable interest rateMinimum deposit required to open is $100.00

*Ask a PTGassociate for details.

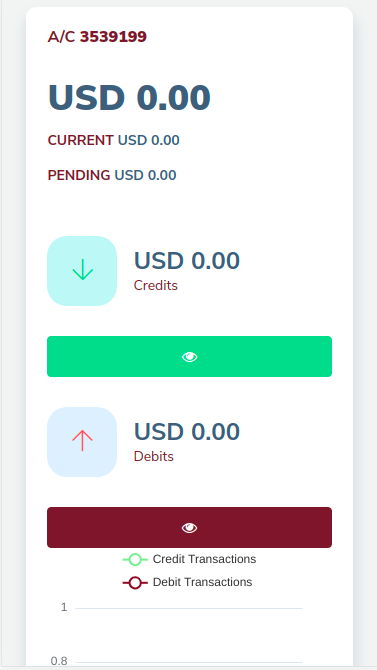

Banque Du PTG has you covered with our Mobile Banking apps. Wherever you might be, whenever you need to bank, we’re as close as your smartphone. Best of all, it’s secure, convenient and free.